Millennials and Gen-Z investors have been raised in a mature and fast-paced market; this pushed fixed-income investing into the back seat in their minds due to the dynamic stock market with potentially superior returns. But once you come of age and approach retirement, Returns from Fixed Income become your purple patch. At this stage of life, preservation of capital and guaranteed consistent income stream become critical.

In today’s dynamic world, investors often get confused and mixed up with exposure to different asset classes to work on getting maximum portfolio returns, reduce risk and beat inflation. The core principle of Value investing suggests a portfolio with a mix of stocks and bonds for later-stage investors.

Historically we are taught that stocks far outpace the returns from fixed income instruments. Statistically, there is not much difference in the returns between these two. During recessions, especially during the great depression, the Global stocks returned merely 6% annually, and bonds delivered inflation-adjusted real returns of about 3% during the same time.

Long Bonds Plummet quick

The beginning of the 21st century brought a vital flip to fixed income investing.

Long bonds (Bonds with a maturity greater than ten years) have not been delivering as substantial yields as they used to, and they have a yield pretty close to short-term yields.

This way, it does not make sense to invest in long-term bonds and lock in your cash for two decades only to realize a difference of 20 or 30Bps is not worth the while.

If you happen to look at their yields and plot them on a yield curve, you will realize, If you invest in 7-15 year bonds, there is little yield pickup, and when short-term bonds mature, the longer ones deliver even lesser yields.

This opens up a possibility for the fixed income investor; the investors can invest the charges when the 5-10 year bonds mature, reassess the economic situation, and regulate their portfolio as they want. Lowered yields can tempt the bondholder to tackle the additional risk with Bond Laddering.

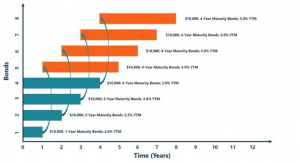

What is a Bond Ladder?

The bond ladder, in simple terms, is an investment strategy which revolves around creating a portfolio in which the bonds or other Debt securities mature at an equal interval continuously. When one of the bonds expires on maturity, the investment gets rolled over to the end. This enables an equally spaced maturity of bonds in the portfolio. This enables you to high average yields while reducing interest rate and liquidity risks.

There are multiple reasons to use this strategy. This enables the investor to leverage fixed-income securities with longer maturity and higher yields instead of locking funds into long-term fixed security and losing liquidity. The bond ladder ensures some liquidity since bonds are constantly reaching maturity at equal intervals.

The main advantage this strategy carries is that it reduces interest rate risks. Long bonds get affected more by the changing interest rates. With the ladder, even if the interest rates are changing, and since bonds are constantly maturing, these can be rolled over and reinvested at a new market rate.

This also adds diversity to the investor’s portfolio. Not only does it involve different maturities, but it also incorporates different debt instruments with different ratings.

Portfolio Diversification

Portfolio diversification is one of the primary methods of Risk Management. Different types of investments in a diversified portfolio will help the investor achieve higher long-term yields.

1. Equities

Add some credible, dividend-paying equities that will balance your portfolio. Such balanced portfolios have become a valuable new model for modern investors, not just Gen Z ones but also investors in their retirement years. Plenty of large-cap companies pay yields over inflation rates and allow investors to participate in corporate profit growth.

You use a simple stock screen to select high dividend-paying companies with a lower beta (ideally less than 1), high growth (PEG ratio of less than 1.75), and selecting different companies from different sectors will minimize sector-specific market risks.

2. Real Estate

A prime piece of property offering you plenty of rental income can come in handy in your later years. You do not have to turn into a landlord; you can simply invest in Real Estate Investment trusts(REIT). These securities are distinct and provide high-yield, trade-like stocks.

REITs are a way to diversify your modern fixed income portfolio against equity market risks and bond credit risks.

3. High-Yield Bonds

High-yield bonds, also known as Junk Bonds, can be a strong potential avenue for investment. These debt securities offer above-market yields and are difficult to invest individually with confidence. But if you select a bond fund based on its consistent operating results, you can allocate a portion of your portfolio to high-yield bond issues as a simple way to boost your returns from fixed income.

Most high-yield funds will be closed-end; they may trade at a price higher than their Net Asset Value. As a margin of safety, you can look for funds trading as close to NAV for investing

4. Inflation-Protected Securities

Adding Treasury inflation-protected Securities or Inflation-indexed bonds is a great way to defend against inflation from a future perspective. Even though they offer a modest coupon rate, the real benefits come from the automatically adjusted price, keeping pace with inflation.

5. Emerging market Debt

Similar to high yield bonds, Emerging market bonds are best invested in through a mutual fund or an Exchange Traded Fund. Individual bonds or issues can sometimes be illiquid and hard to research properly. The yields for these issues have historically been higher than the advanced-economy debt. They provide better diversification and help deter country-specific risks.

Since these emerging market funds are also closed-end, you should look for the ones priced closer to their NAVs.

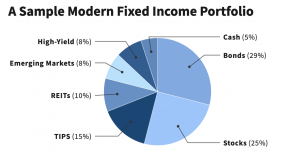

Sample Modern Fixed Income Portfolio

This sample modern fixed income portfolio provides a balanced and valuable exposure to different markets and other asset classes, keeping in mind the adequate safety needed.

Conclusion

Fixed income investing has evolved dramatically within a short span of time. As the aspects become trickier, investment markets provide more tools for the modern fixed-income investor to create better custom portfolios. Being a successful investor means taking an out-of-the-box neo-classical approach and using modern tools to create a portfolio.

RURASH is one of India’s investment management firms, providing financial solutions to augment the client’s wealth and build a legacy.

For any guidance regarding financial instruments, Connect with the relationship manager now or write to: invest@rurashfin.com.

Also Read: India’s digital payments revolutionized – UPI Lite and other key initiatives launched this week