In this article, we will talk about international stocks: why you should invest in them, the associated risks, and how to invest in international stocks.

Investors in India have access to numerous domestic companies to invest in. There is an abundant choice, with over 7,400 listed on the National Security Exchange (NSE) and the Bombay Stock Exchange (BSE). While the Indian companies have produced sufficient returns for the investors in the past, there is potential to generate more.

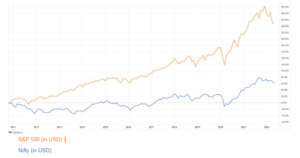

Historical Performance Comparison between S&P 500 and Nifty

These excess returns may come from foreign markets. As a matter of fact, the US market has historically outperformed the Indian market. Also listed outside India are some of the world’s most renowned companies: Apple, Google, Tesla, Microsoft, etc. These companies have greater potential with access to a broader market than most domestic companies. Investing in these international stocks allows investors to be a part of the company’s growth and diversify their portfolios.

Pros and Cons of Investing in International Stocks

Individual investors increasingly have access to numerous investment opportunities outside their domestic market. With the growing popularity of international investing, it is necessary to understand the benefits and risks involved before diving into global investing.

Pros (Benefits) of investing in international stocks:

- Global Diversification:

This is a well-established concept of investing. Investing in international stocks protects investors’ portfolios from country-specific risks such as an economic slowdown or political instability. In addition to this, investors also benefit from the profits of multinational companies (MNCs)

The investors will not only be benefitting from investment in different companies but also across different currencies. - Growth:

Different economies have different growth potentials. Investing globally allows investors to capitalize on the profits from growing economies. It also provides wider investment choices, empowering investors to take part in the growth journey of their preferred companies. - Currency Appreciation:

Historically, the Indian Rupee (INR) has depreciated against leading global currencies like USD, GBP, EUR, JPY, etc at an annualized rate of about 5%. Investing globally has enabled investors to hedge their capital gain against a rising US dollar, which has typically appreciated around 5% annually.

Although emerging economies’ currencies depreciate in the long-term, their rising rates have allowed investors to reap the dual benefit of better markets and currency appreciation.

Cons (Risks) associated with investing in international stocks:

High Transaction Costs:

International investing attracts more charges than domestic investing, making this one of the most significant barriers to investing in global markets. The transaction costs vary according to the country. They typically involve foreign exchange charges, transfer fees, annual maintenance fees, etc.

Foreign Exchange Risk:

Foreign exchange rates are volatile and subject to change. These fluctuations may either cause the investors’ returns to fluctuate. In addition, some countries may impose Foreign Exchange control measures to stabilize their economy. This will restrict or delay investors from moving capital out of the country, generating liquidity risks.

Like we are seeing in Russia, Sri Lanka, China…

Political and Economic Risks:

It is challenging for investors to understand in-depth the political and economic factors affecting the market of every foreign nation they are investing in. Political events affect the domestic market and sometimes the global markets. The rise of any unwanted and uncertain geopolitical could lead to volatility, affecting the domestic markets. In developing countries, government decisions can hurt even the most prominent companies.

The recent Chinese government crackdown on its tech industry is one such example. All these political risks affect the investors’ returns. Economic risks arise when there is an adverse change in the macro-economic factors. The unemployment rate, interest rate fluctuations, political instability, rising inflation, etc., are some macroeconomic factors that can severely impact an economy. Investors should, therefore, evaluate the macroeconomic aspects of the country that they are investing in to avoid economic risks.

How to Invest in International Stocks:

Investments outside India are governed under Foreign Exchange Management Act (FEMA), 1999. The Liberalized Remittance Scheme (LRS) is a scheme of the Reserve Bank of India (RBI). Introduced in 2004, the LRS allows all resident individuals, including minors, to freely remit up to $250,000 per financial year per person for any permissible current or capital account transaction. Simply put, a resident can invest up to $250,000 per financial year (April-March) in international markets.

There are various avenues through which an individual can invest in the international markets (or stocks). Some such routes of investment are:

Overseas Trading Account

Investors can open an overseas trading account either with a domestic broker or an international broker.

- Through domestic broker:

Opening an overseas trading account with a domestic broker that has collaboration with international brokers. Many domestic stockbrokers (HDFC Securities, Axis Securities, ICICI Direct, JM Financials etc.) have partnerships with foreign stockbrokers. These brokers act as intermediaries and facilitate trades. However, investing costs tend to be higher due to combined brokerage and currency conversion charges. It should also be noted that investments through such intermediaries are limited due to the various restrictions. - Through foreign brokers:

Opening an overseas trading account with a foreign broker that has a presence in India. Some foreign brokers are Interactive Brokers, Saxo Bank, eToro, etc. However, many foreign brokers require investors to maintain a minimum amount on their accounts. Proper research must be done to understand its fees and charges before opening an account with a foreign broker.

Investment through GIFT City IFSC:

Gujarat International Finance Tec-City (GIFT City) is an emerging financial hub for financial services activities. The National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) offer Indian investors the opportunity to invest in international stocks. While both these exchanges offer the same service, they have radically different models. The NSE-owned NSE – IFSC offers investors unsecured depository receipts to invest in foreign stocks. It has created unsecured depository receipts for 8 (eight) large US companies. It plans to create these receipts for 50 (fifty) of the largest US companies.

Since the offerings are unsecured depositary receipts, this can offer some regulatory comforts to Indian investors unfamiliar with foreign regulators and their regulations. However, the choices available are pretty limited, with just 50 stocks of the largest US companies. The BSE-owned India INX has collaborated with Interactive Brokers, a US-based broker. It is acting as an intermediary and not as an exchange. Its consumers have access to the entire universe of stocks and ETFs listed in the US and other markets.

A brief comparison between the NSE-owned NSE – IFSC and the BSE-owned India INX

| PARTICULARS | NSE – IFSC | India INX |

| ROLE | Functions as an exchange | Functions as an intermediary |

| PRODUCTS | Unsecured depositary receipts | Stocks, bonds, ETFs, etc. |

| UNIVERSE | 50 top US stocks | Entire US market and other markets |

| CHARGES | Forex, brokerage, demat, receipt creation, and extinguishing charges | Forex charges, brokers’ commissions (if any) |

| DISADVANTAGE | Since the offerings are unsecured depositary receipts, investors do not have access to shareholders’ benefits and voting rights | Since money invested is transferred outside India, there is an additional risk associated with the destination country |

| SUITABLE FOR | Those investors that want to invest only in top US stocks | Those investors that want access to the entire offerings of the US market and other markets |

Mutual Funds

Individuals can invest in international stocks by opting for international mutual funds available in India. These may be either an international fund or an Indian fund that invests in foreign stocks.

An international mutual fund primarily invests in equity instruments and debt securities of entities listed on the foreign markets. US-focused mutual funds are the most popular and demanded in India. Some US-focused mutual funds available to the Indian investors are ICICI Prudential US Bluechip Equity Fund, Nippon India US Equity Opportunities Fund, Motilal Oswal NASDAQ 100 ETF, etc.

Investment through this mode is particularly suited for individuals who lack a strong understanding of the stock market but want to invest in international stocks. Also, the capital required in this investment model is low compared to the other investment methods listed in this article.

The Association of Mutual Funds in India (AMFI) has recently asked mutual fund houses to stop accepting fresh investments, be it lumpsum or Systematic Investment Plan/Systematic Transfer Plan, into schemes dedicated to international stocks. This ban came about as the mutual fund industry had almost reached its limit of $7 billion set by the capital market regulator, Securities and Exchange Board of India (SEBI). This ban came into effect on February 2, 2022.

The industry is waiting for the limit to be hiked by the Reserve Bank of India (RBI), which indirectly put the limit in place. The foreign investment limit was hiked to $1 billion for each fund house in June 2021 and doubled to $ 600 million in November 2020.

Exchange-Traded Funds (ETFs)

Exposure to international stocks can also be achieved through investing in ETFs. There are direct and indirect paths available. The direct route would mean buying international ETFs through domestic or foreign brokers. The indirect way would be purchasing an Indian ETF of international indices.

Like mutual funds, ETFs are a collection of numerous equities and bonds traded under a fund. But, unlike mutual funds, they are listed on stock exchanges and traded during regular trading hours with fluctuating market prices. Furthermore, since the ETFs are passively managed, they have a lower expense ratio than actively managed mutual funds.

Some examples of international ETFs available to the Indian investors are MOSL NASDAQ 100, HDFC World Index Fund, Mirae Asset NYSE FANG+ETF, etc. The recent ban on mutual funds from issuing fresh subscriptions has driven investors to ETFs. Therefore, investors buying ETF units must carefully check the prices. They may be quoted at a premium to net asset values as new units won’t be created until the ban is lifted.

Conclusion

There is a growing appetite among Indian investors to invest in international stocks. Investing in foreign stocks is an excellent way to diversify the portfolio. While there are many avenues available to Indian investors to invest globally. It is essential to understand the pros and cons of each investment path and make an informed decision.

Investors should also be aware of the different charges attracted under international investing and the corresponding risks associated with it. In addition to these, investors must also ensure compliance with foreign exchange control regulations and report foreign assets and income in the country of investment.

RURASH is amongst the best Indian investment management firm, providing financial solutions to augment the client’s wealth and facilitate building a legacy.

For any guidance regarding financial instruments, Connect with the relationship manager now on Call at +91 22 4157 1111 or write to: invest@rurashfin.com.

Also Read: How can you invest in Unlisted companies or Private Companies?