One of the most popular and insightful pieces of advice “Warren Buffet” ever gave us was

Rule Number 1: Never lose money.

Rule Number 2: Never forget Rule number 1.

This illustrates that as much as we are concerned about the returns from the market, we should be concerned about the risk associated and whether we can take any amount of risk.

Returns and Risk go hand in

Risk has a heavy bearing on the investment decision of every individual.

What is a Risk Profile?

In simple terms, the risk profile quantifies your risk tolerance levels as an investor.

Each investor has a different risk tolerance for the market volatility and varies with a few factors such as disposable income, age, etc. A risk profile will help you and the investment experts to create a specific investment plan and portfolio with a mix of assets better suited for your profile.

Organizations leverage risk profiling to take measures to minimize the impact or avert impending losses.

Risk tolerance is specific to an investor, and in simple terms, it quantifies your ability as an investor to take on risks and volatility, thereby dealing with consecutive returns. A risk-averse investor would be okay with moderate returns to maintain the value of the investment. Contrary to it, an investor who is okay with dealing with market volatility and can withstand it is called a Risk seeker investor.

How to assess Investor Risk Profile?

Generally, investors use their financial standing (The Asset and Liability Balance) to measure the level of risk they can take. Financial experts only rely on the asset-liability balance to factor in the risk profile measure.

An investor with a large number of assets compared to liabilities and is investing with an aim for exponential returns will mostly be categorized as Risk-Seeker. Risk-aversive investors have limited headspace to accommodate any loss for any short-term volatility and are more inclined to look for safer investments.

Fewer liabilities do not necessarily mean that the investor will be a risk seeker; it also depends upon the investor’s own understanding of the risk in that case.

A few other factors affect your risk profile or your risk tolerance.

- Age: As a young investor, you are more open to taking risks than an investor near his retirement age.

- Lifestyle: If you are unmarried and do not have any dependents in the early stage of your career, you can take more risk than a married investor with dependents.

- Financial Goal: Financial Goals also affect risk tolerance a lot; if your goal is to amass a substantial corpus for your retirement, you would prefer an equity-intensive portfolio predominantly.

- Psychological factors: Your overall feelings and emotions affect your ability to take risks. If you’re not confident with your investment decision and are worried too much about your potential loss, you would prefer a conservative approach, investing in investments with minimum volatility and risk, even if that means moderate returns.

- Loss bearing capacity: As an investor, you would not want to invest to lose money; however, it becomes important to consider that If your portfolio were to deliver negative returns, how will that affect your lifestyle? You should not invest capital that you can not afford to lose

- Income & expenses: A regular income indicates stability, and a stable source of income is beneficial when investing. Since the income in future is certain, you can take higher risks compared to a person with a seasoned income. If you have high unchecked expenses, you will be able to allocate a lesser amount to investing as your savings would be low, and you will not be able to take on higher risks due to the fear of potentially losing it all.

Broad Categories of Risk Profiles

We can classify risk profiles into three broad categories, which may have subtypes based on the aforementioned factors.

1. Conservative

These risk profiles have a lower risk aptitude. The main inclination of investors with this profile is towards investment options that ensure the safety of corpus more than any other thing. The returns are not a concern as long as they are not negative. Typically a conservative risk profile investors have a short period of investment horizon.

Investment options well suited for these profiles are Treasury bills, Corporate Bonds, sovereign bonds,debt-backed securities, and debt-based mutual funds.

2. Moderate

Moderate risk profile investors strive toward creating a balance between returns and risk. They go for higher returns with an agreeable level of risk. Their portfolio will consist of a moderate amount of equity and the required debt securities to dilute the risk.

They may also invest singularly in equity-based mutual fund units.

3. Aggressive

Investors with an aggressive risk profile are most likely to agree to and withstand the market volatilities in anticipation and the hope of exponential returns. These investors usually understand markets quite well and are seasoned in them. They carry a long-term investment horizon, which is why short-term volatilities don’t affect them much, ergo they can digest short-term market volatilities easily.

These investors predominantly go for equity-based assets and have a positive asset-liability balance. Young investors with sufficient disposable income also come under this risk profile.

How can you determine your Risk Profile?

The general approach by which financial advisors and Robo-advisors prepare a risk profile is through questionnaires. These questionnaires are designed in such a way that they fit the individual risk appetite of the individual in a numeric or objective manner.

There also could be choice-based questions to measure an individual’s risk profile as how the financial advisor or institution may deem fit.

Conclusion

When you’re trying to evaluate your risk tolerance or your risk profile, there are a few important points to consider

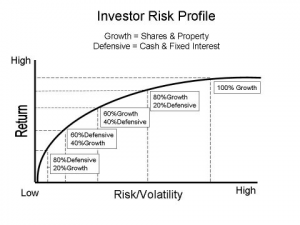

- The greater the return you’re expecting, the more risk you will have to take

- The higher the return you want from your investment, the greater the chance of losing some of the investment or all of your initial investment.

- When investing for the long term, you can accommodate additional risk.

There is a risk attached even with the long-term investments but you can recover your losses with time, as markets inevitably correct themselves over a period of time.

Rurash offers complimentary risk profiling and investment goal planning before any stock recommendation. Rurash is one of India’s investment management firms, providing financial solutions to augment the client’s wealth and build a legacy.