Bonds are a favorite addition to the portfolio for investors focused on capital preservation. Unfortunately, many investors do not realize that with debt instruments, there are also a few risks associated. Let us look at seven commonly overlooked mistakes that Bond investors make.

What are bonds, and how do they work?

Debt Financial instruments include fixed and variable bonds, debentures, notes, certificates of deposits and even bills. Governments and corporations use them to raise capital to finance different activities and projects. Different types of debt instruments offer different returns, but with higher returns, we must assume higher risks.

Entities which issue bonds are called issuers, and the investors who buy bonds are called bondholders.

Features of Bond/Debt Securities

- Coupon Rate: The coupon rate is the yield paid to the buyer.

- Maturity date: The date upon which the buyer will redeem the security.

- Call Provision: The outline of the available options for the company to buy back the debt at a later date

- Call information: Bond being called back is a tricky one to look at because this one can have multiple pitfalls. Suppose the interest rates decline too much after you’ve purchased the bond. In that case, the price of your holding will increase, but this also opens up the possibility of the issuer company to float another bond to raise money at a lower interest rate, and from those proceeds, move ahead to call your bond or buy back it. In most cases, the issuer will offer you a small premium to sell the bonds back to them before they mature. But you will be forced to reinvest the money at lower market rate

Mistakes to Avoid While Buying Corporate Bonds.

- Ignoring Interest Rate Movements :

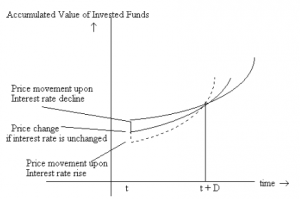

Interest Rates and bond prices share an inverse relationship. As interest rates go up, the bond prices will go down and vice versa. This means near the maturity date of the bond; the issue price will vary quite widely as the interest rate fluctuates. Many investors tend to ignore it, but is this volatility avoidable? For that, we need to look at the mechanism of the interest rate risks. When you buy a bond, you are promised a fixed rate of return, also known as the coupon rate for the specified tenure. If markets rise after you purchase your bond, bond prices will fall accordingly. If you sell your bond further in the secondary market, the bond will then trade at a discount to accommodate the lower returns a buyer will make on the bond.

Conversely, when the markets fall, the issued bond will sell at a premium because of higher coupon payments than those offered on a freshly issued bond. Market interest rates depend upon multiple factors, including money supply and demand in the economy, the inflation rate, and Fiscal and Monetary Government Policy.

Thus, the bond-holders should hold the bonds till maturity irrespective of the length; you should be prepared to hold the bond till its redemption date. If you sell the bond before its maturity, you may incur a loss if the interest rates move against you.

- Not Paying attention to the claim status.

It is always important to understand the debt you hold, especially in speculative cases, i.e. if your buying is backed by speculation. Some bonds are backed by collateral that are given the first claim before other bonds in situations of liquidation or bankruptcy. Subordinated debentures are paid before common stock regarding the claim preference.

In bankruptcy, bond investors get the first claim over the company’s assets. Simply put, they have a better chance of being paid fully if the issuer company goes bankrupt.

You can check the certificate to determine the type of bond you own. It will indicate the bond status in some manner.

Alternatively, you can reach out to the broker that sold you the bond; he can easily provide you with the status. You can look into the company’s financial documents if your bond is an initial issue.

- Assuming a Company is healthy and sound.

Owning a bond, or just because the company has a good name in the market, will not guarantee you a dividend or that you will get to redeem your bond. In many cases, investors take this for granted.

But rather than assuming, you should look for yourself by reviewing the company’s financials to ensure that there is no reason that the company may be unable to fulfill its obligation. You should look closely at the income statement and then at annual net numbers, depreciation, taxes or other non-cash charges. Ideally, there should be at least twice the coverage than the debt service numbers for the company to pay the debt.

- Inappropriately judging the Market Perception.

As we know, bond prices are subject to market change and can also fluctuate. One of the biggest drivers of this volatility is the market perception of the issue and the issuer. If the market believes that the company will not be able to meet the obligation, this could severely impact the company’s reputation, and thus the price of the bond will plummet. The Opposite holds true if Dalal Street finds the issue or the issuer favorable, the bond price would go up.

The quicker way to do it would be to see how the issuer company’s common stock is perceived. If it is disliked, it would also reflect in the bond prices.

- Not checking the company history.

Investors should check old annual reports to review the company’s past performance to determine the consistency in its earnings and whether all of the tax, interest and other obligations are met. Any potential investor can easily find this information in the company’s Management Discussion and Analysis(MD&A). You can also go through the company’s proxy statement, which can give you clues about the company’s past inability to make payments due to any circumstance.

This goal is to boost your comfort level so that the bond you’re buying does not seem like an experiment. This enables you to check whether the company has paid its past debt obligations based on the past performance, it is likely to do so in the future.

- Ignoring Inflation

When the inflation numbers are out, you should always pay attention to them. Inflation can severely affect a bondholder’s future purchasing power severely. Particularly for the investors that buy bonds with a yield less than the inflation rate. This way, they ensure that they will inevitably lose money.

This does not mean you should not buy bonds with low yields from high-rated companies. This is to simply understand that to defend against inflation, you can hedge your investments by obtaining higher returns from your stock investments or other high-yielding bonds.

- Failing to check for liquidity.

It is always advisable to check for the issue’s liquidity through the information available from Financial publications, market data services, your broker, or the company’s official website. Any one of these sources can give you a credible insight into the daily trading volume of the bond.

This will come in handy if you want to sell off your bond as you will need adequate liquidity; this will also ensure that the issue is well accepted in the market by the buyers.

Is there any recommended liquidity level? No, but if

- The issue has a large daily trading volume

- It is quoted by large brokerage houses

- It has a narrow spread

The issue is fairly a suitable issue.

Final Thoughts

In a broad perspective, bonds are less risky and more conservative than equity stocks. But contrary to popular belief, they do require intensive research and analysis. Those who fail to do their homework and research can have negative returns. Corporate Fixed deposits and bonds offer higher returns, and Rurash helps you invest exclusively in bonds with AAA ratings from authorized credit rating agencies.

RURASH Financials helps people choose companies with strong ratings for a better investing experience.