ABOUT THE COMPANY

Indigo Paints is the fifth largest and fastest growing company in the Indian decorative paint industry. The company has been able to achieve this position in highly competitive market by introducing differentiated products to create a distinct market in the paint hard work, building brand equity for primary consumer brand of ‘Indigo’, creating an extensive distribution network across 27 states and seven union territories as of September 30, 2020, and installing tinting machines across our network of dealers.

The Company manufactures a complete range of decorative paints including emulsions, enamels, wood coatings, distempers, primers, putties and cement paints. Under the ‘Indigo Differentiated Products’ in the decorative paint market in India, product category such as Metallic Emulsions, Tile Coat Emulsions, Bright Ceiling Coat Emulsions, Floor Coat Emulsions, Dirtproof & Waterproof Exterior Laminate, Exterior and Interior Acrylic Laminate, and PU Super Gloss Enamel, are manufactured by the company, where company’s strategy remained to first focus on Tier 3, Tier 4 Cities, and Rural Areas, where brand penetration is easier and dealers have greater ability to influence customer purchase decisions. Subsequently, the company focused to Tier 1 and Tier 2 cities and Metros. As the first company in India to develop these products, we have had an early mover advantage in the markets we are present in, which has allowed us to realize relatively higher margins for these products compared to the rest of our product portfolio.

Other details about the company:

Manufacturing Facilities: Jodhpur, Kochi and Pudukkottai

Current Production Capacity: 101,903 KLPA for liquid paints and

93,118 MTPA for putties and powder paints.

Proposed Production Capacity: 50,000 KLPA for water-based paints

Distribution Network: 36 Depots and 11,230 dealers Pan-India

Tinting Machines: 4296

STRENGTHS OF THE COMPANY

1. Differentiated Products leading to greater brand recognition – Indigo seeks to launch first-to-market products by identifying niche product opportunities and introducing products that address these requirements. The company has a portfolio of seven Differentiated Products, with Metallic Emulsions being the first product introduced in 2015 and Dirtproof and Waterproof Exterior Laminate, being the latest product introduced in the year 2017.These products have enabled the company to build strong brand equity among end-customers and dealers thus aiding penetration of other decorative paint products.

2. Track record of consistent growth in fast growing industry with significant entry barriers – Development of an extensive distribution network through relationships with dealers, the ability to set up tinting machines with dealers, as well as significant marketing costs and the establishment of a distinct brand to gain product acceptance are the major barriers in paint industry. Company’s top-line has grown at a CAG of 41.9% between FY10 to FY19. Even in Covidimpacted FY20, the company has delivered growth of 16.65%, ahead of its peers.

3. Focused brand-building initiatives to gradually build brand equity – The company’s advertising campaigns revolve initially around its core differentiated products and then to other products. Its marketing expenses is at 12.65% of its revenue in FY20, where top four paint companies are in the range of 3.3-5.0% for the same year.

4. Extensive distribution network for better brand penetration – Paint companies are required to spend significant resources to develop their distribution network to increase the visibility and reach of their products through direct distribution to dealers. Being relatively new entrant in the market, the company first focused on dealers in Tier 3, Tier 4 Cities, and Rural Areas, focusing to create larger base of dealers, and subsequently leveraging it to expand into larger cities and metros.

5. Strategically located manufacturing facilities with proximity to raw materials – Locating facilities close to raw material sourcing, reduce inward freight costs and result in lower raw material cost. For example, in manufacturing water-based and cement-based paints and putties at Rajasthan, the company sourced its required raw material from Rajasthan itself and parts of Gujarat.

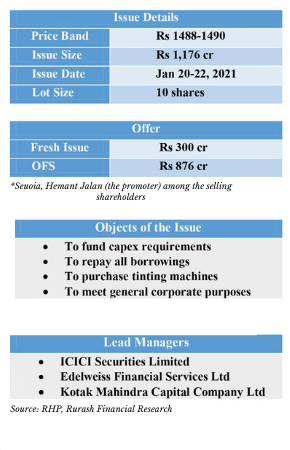

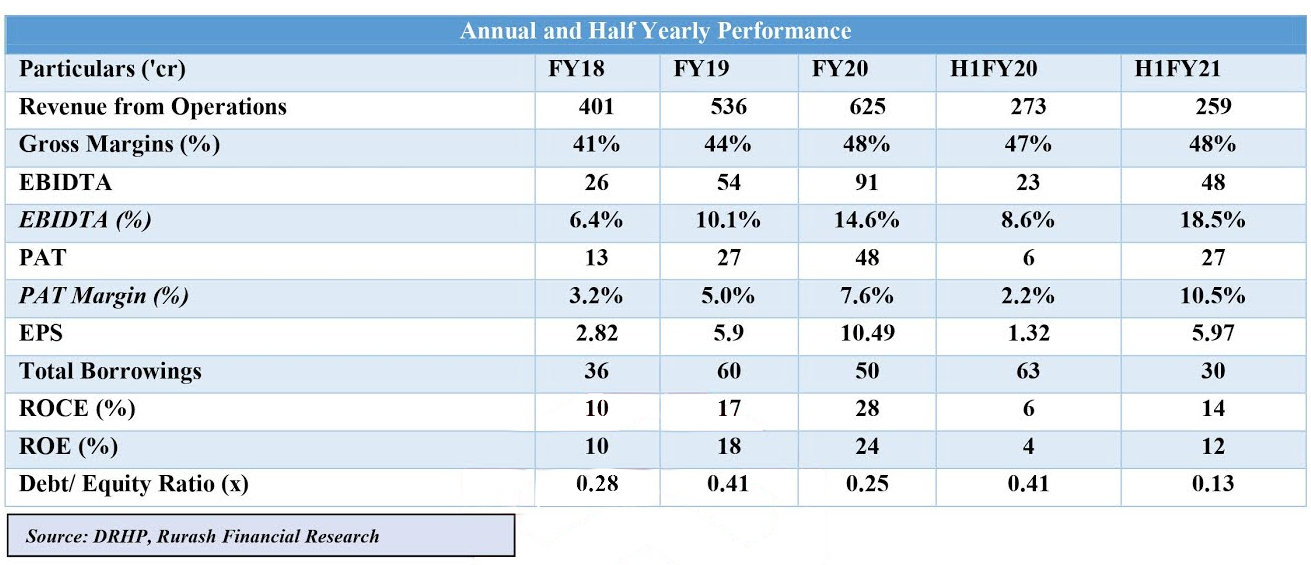

FINANCIAL SNAPSHOT

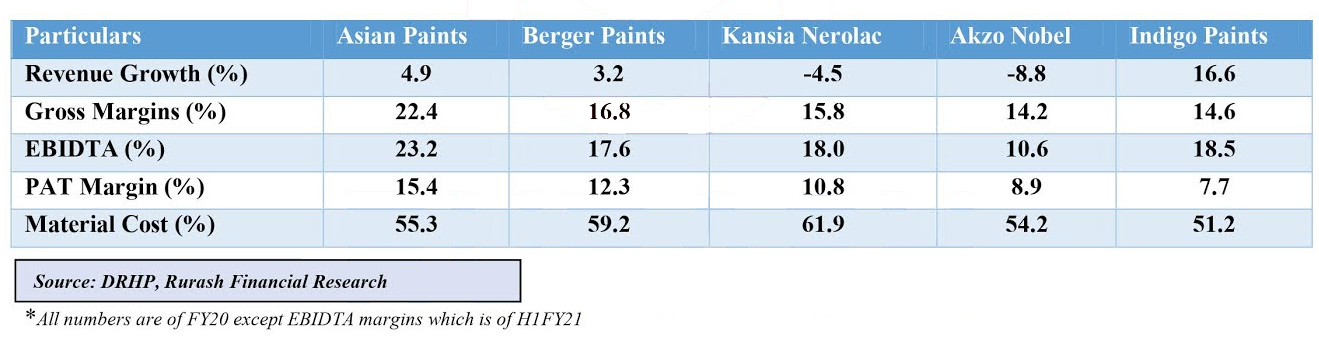

PEER COMPARISON

OUR ANALYSIS AND RECOMMENDATION

Going forward, the company intends to continuously grow its portfolio of differentiated products as these products have widened the end-user base that Indigo cater to, which typically have a higher margin profile than other decorative paint products (command 8-10% higher gross margins than normal products). Henceforth, the company will continue to identify potential product opportunities in the market, and focus on developing category-creator products to cater to distinct requirements in the Indian decorative paint industry. Additionally, the company has lowest net working capital in the industry of 23 days, in comparison to the top 4 players.

From the valuation perspective, Indigo is commanding a valuation of 142x of FY20 EPS and ~125x of FY21E EPS at the upper price band of Rs 1490, while the top two players, i.e., Asian Paints and Berger Paints is trading ~98x and 115x. While the higher premium asked for, is justified to some extent owing to its fastest growth trend of ~40% CAGR in last 10 years, its high-yield products, future expansion plans and above all the growth opportunities in the decorative paint market in India, where management sees greater untap opportunities for the company; we feel that only aggressive investors should go for the IPO and others should wait for the dip to enter into this stock. However, we maintain a positive outlook in the stock and advise to add in the investment portfolio, as the company seems to have the ability to create value for its investors just like in the past Asian Paints has rewarded its long-term investors.

DISCLAIMER

This article is prepared by CA Shraddha Jain, Senior Research Analyst – Unlisted & Private Equity, on January 20, 2021. The views expressed herein are based on the facts and assumptions indicated in the document.

All investment / financial opinions and/or views expressed herein are the personal views of the author. All the information contained herein is to be construed as indicative data which has to be corelated with actual market and economic conditions.

It is very important for investors to do their own analysis before making any investment. The investor should take independent financial advice or independently research and verify, any information herein. The information contained in the report is not intended as, and shall not be understood or construed as, financial advice.

Unintended and misprints may occur despite best efforts to ensure that all information is accurate and up to date.

Please remember at all times that –

- Investment in unlisted securities is subject to market risks.

- Unlisted securities do not offer an easy exit route, such as selling on stock exchange, as in the case of listed securities.

- Any future gains or losses indicated herein are projections, based on our understanding of the market and macroeconomic situation as well as our understanding of the enterprise issuing the unlisted securities, as on the date of this communication. Future course of events may change the projections. We do not assume responsibility to update this report based on such changes.

- We do not guarantee any profits, losses or rate of return

Connect with our team of experts to know all about Indigo Paints IPO now. Call now or drop a mail to invest@rurashfin.com.