Incorporated in 2002, the AMC UTI Mutual Funds is in the business of managing the domestic mutual funds, it provides portfolio management services to institutional clients and high net worth individuals like Employee Provident Fund Organization, National Skill Development Fund, Postal Life Insurance, and manages retirement funds etc. NPS, offshore funds like Shinsei UTI India Fund, and alternative investment funds catering to a diverse group of individuals, institutional investors, banks, trusts, and NRIs are also covered under the portfolio of UTI Mutual Funds.

UTI AMC has a national footprint with 163 UTI Financial Centres, 273 Business Development Associates, Chief Agents and 33 other Official Points of Acceptance. UTI AMC also has approximately 51,000 Independent Financial Advisors empaneled with them.

UTI AMC has four sponsors SBI, LIC, PNB and BOB. Each of these have the Government of India as a majority shareholder. UTI AMC also has a global asset management company T. Rowe Price International Ltd as one of its major stakeholders with a 26% stake in the company.

As of September 30, 2019, UTI AMC manages 178 domestic mutual fund schemes, comprising of equity, hybrid, income, liquid, and money market funds.

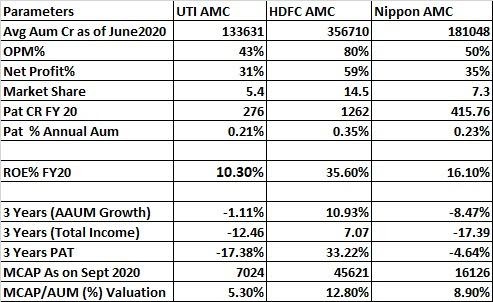

Looking at financial numbers, among its peers it is the HDFC AMC that is a best alternative and also offers consistent returns, AUM growth along with better ROE.

Looking at comparisons and financial performance analysis, our take for investors is to stay with HDFC AMC & Nippon amongst the listed peers. UTI will take exit on listing, says Manthan Mehta Head – Unlisted Equity at Rurash Fin.